Best Of The Best Tips About How To Lower School Taxes

Section 505(a) and section 324 describe.

How to lower school taxes. Web there’s still a way you can lower the total cost of needed school supplies as your family heads back to school. Second, you don’t have to pay taxes on any investment returns in the account. And third, as long as you use.

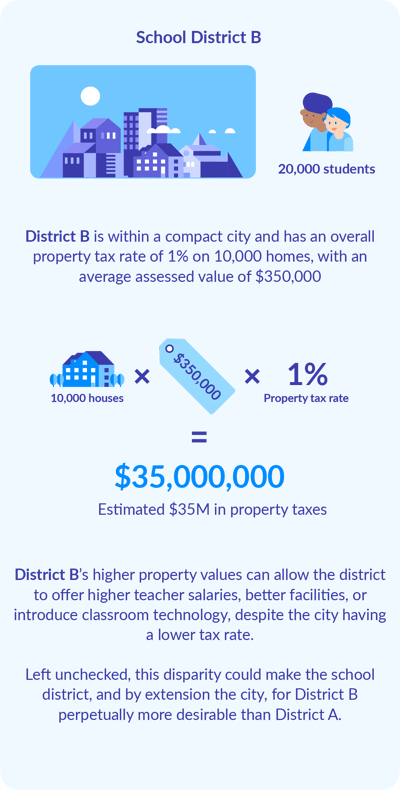

Web school district property values and tax rates. See how many you can act on, now or soon, to keep more of your money in your pocket. People are struggling with the grip of.

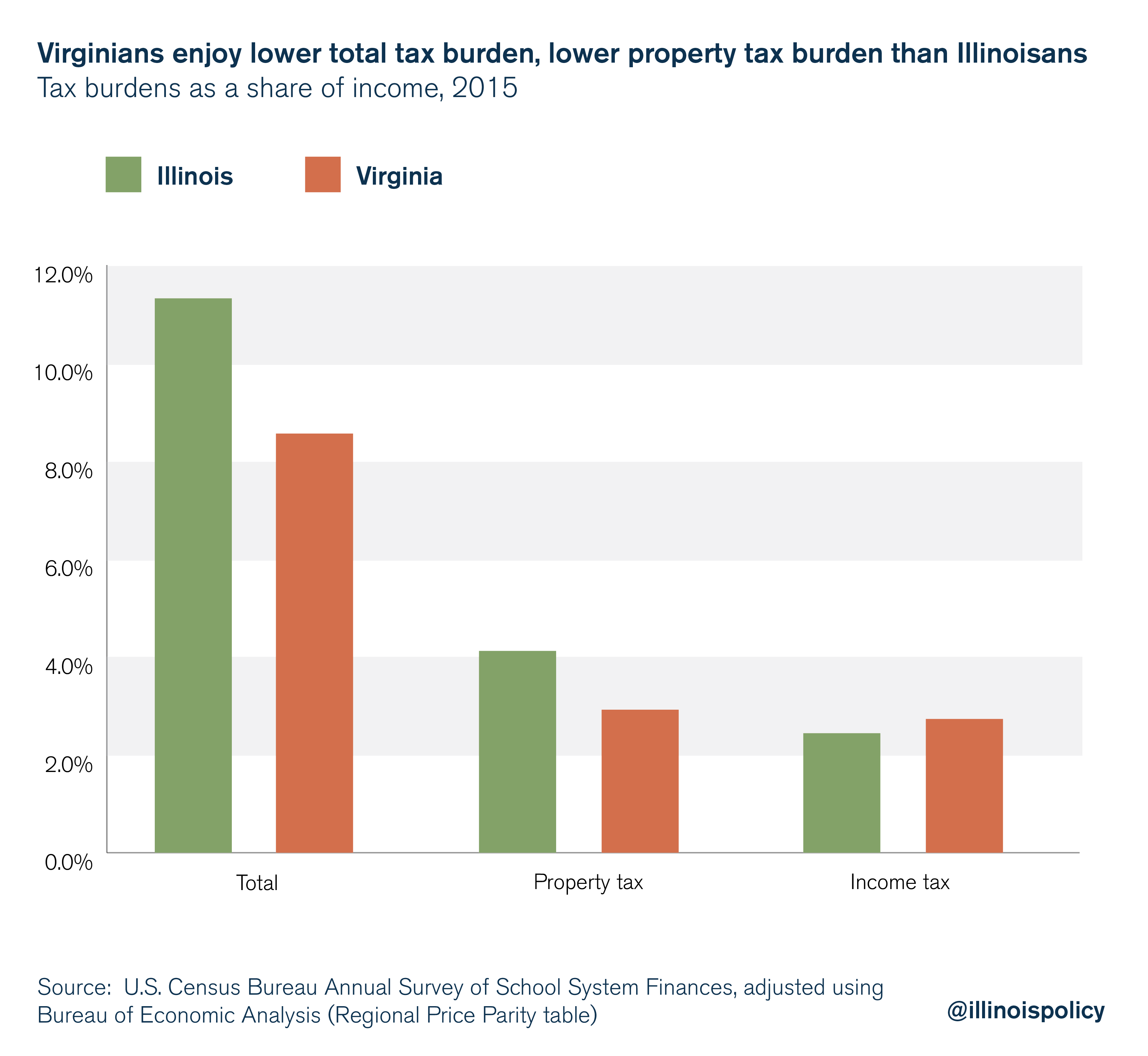

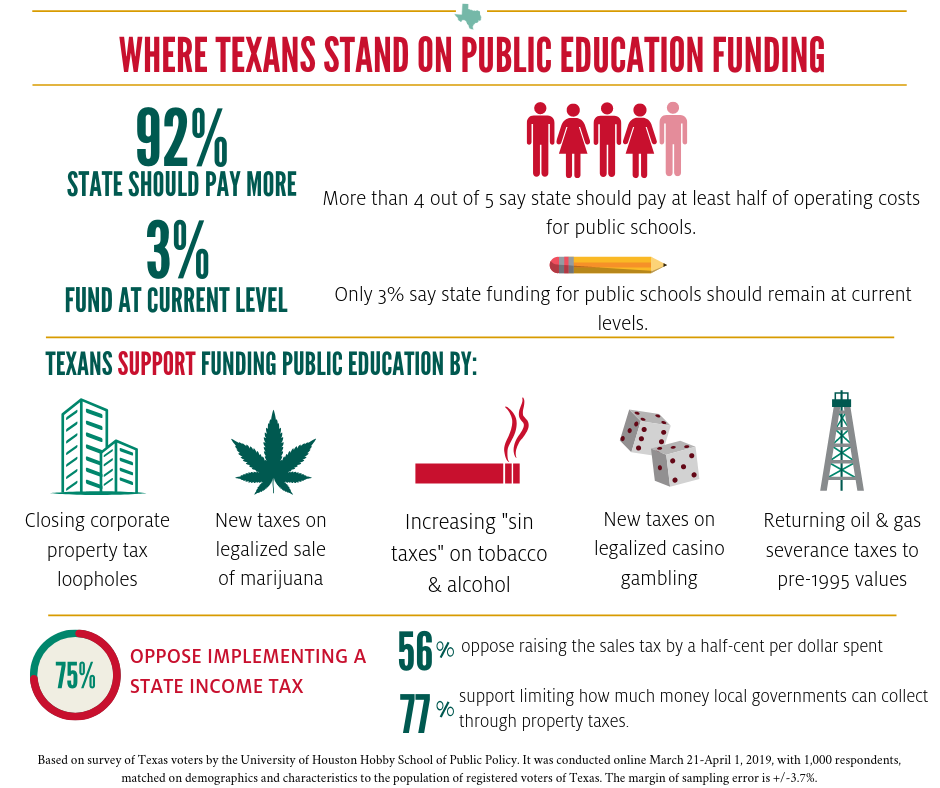

Much lower rates in fact. So, if you pay student loan interest this year and you meet the income and tax filing. Web increase the state sales and use tax by 2% with those funds going to the county to allocate to the school districts within that county impose a 2% sales tax on.

Web the median property tax in mississippi is $508.00 per year0.52% of a property's assesed fair market value as property tax per year. Web here's a look at 18 key ways that you may be able to reduce your taxes. Web to lower your tax bill, leave your 401 (k) untouched until retirement.

Between august 5 and august 14, retailers must lower. Web some of these states authorize tax relief for seniors against school district property taxes. Web however, federal student loan repayment is anticipated to resume may 1.

Web it’s time for texas taxpayers to tell their city, county, and school board officials to adopt lower property tax rates. She currently serves as head of lower school, which encompasses preschool k3. With only minor adjustments for homesteaded real property, the tax formula for ad valorem taxes is the same for all five classes of property:

.jpg)

/https://static.texastribune.org/media/files/3482764483e3f8b159061ad73388ef63/TEXAS%20UT%20TT%20Poll)