The Secret Of Info About How To Get A Itin

You can also form a business here.

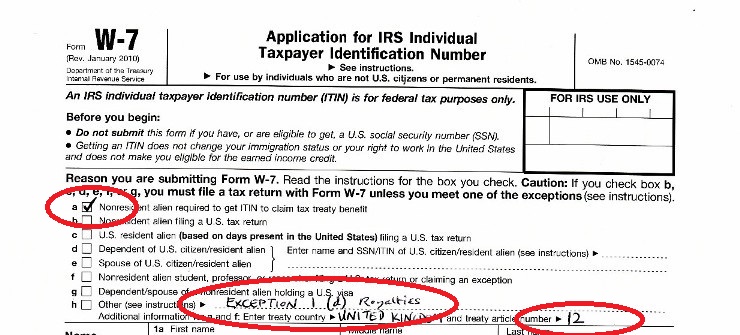

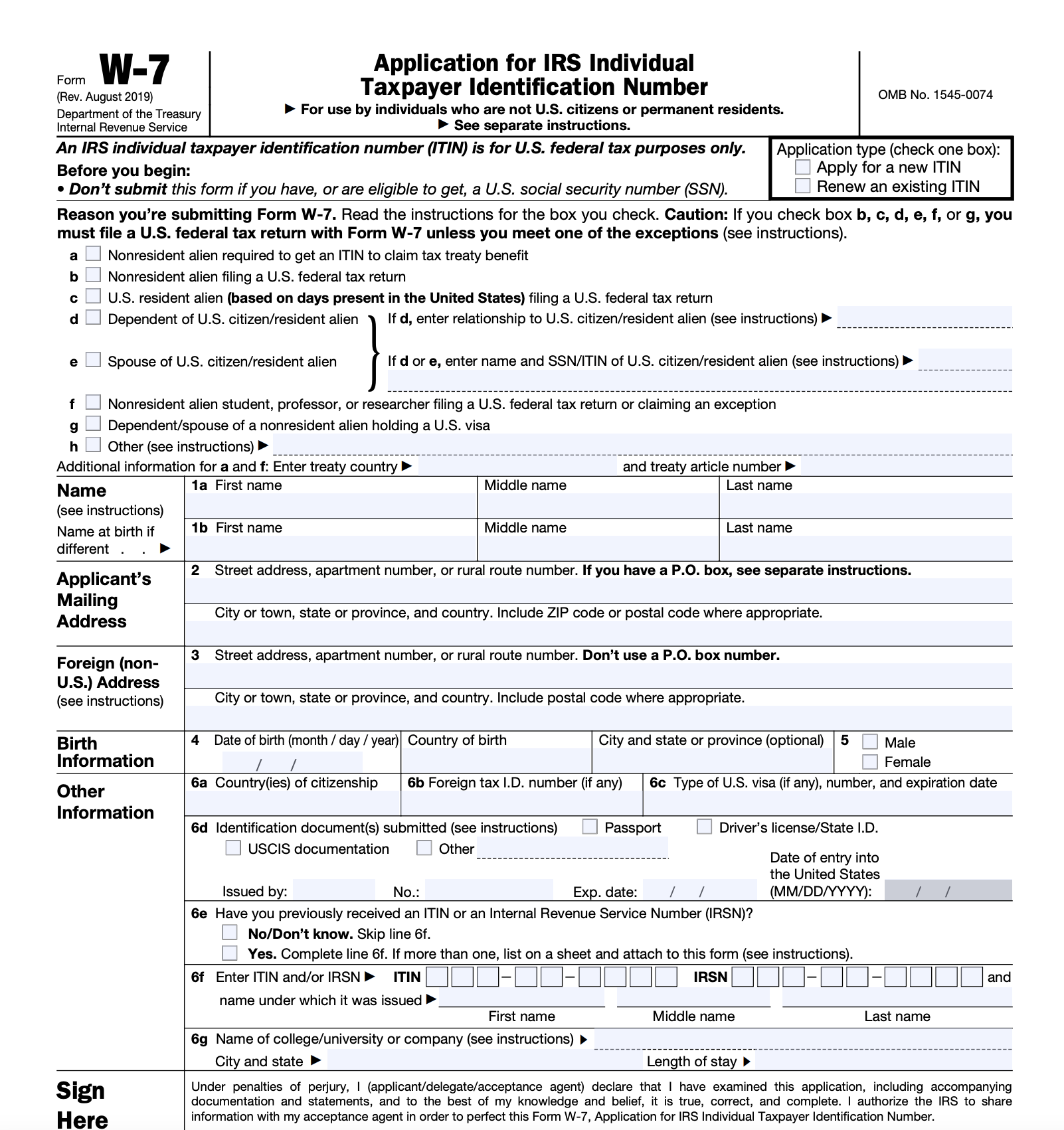

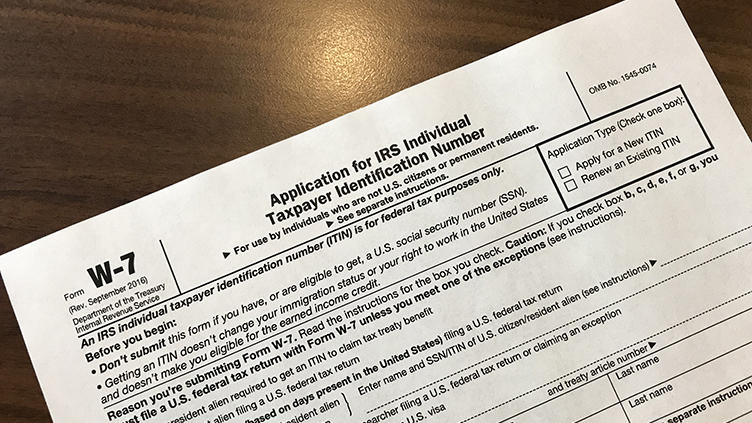

How to get a itin. However, because of the complexity of the form. This number can be obtained online through a form to be completed on the irs website. You can apply for a new itin by mail using the instructions listed below:

The ein is the tax id number for a business entity, whether you’re a sole proprietor, or an llc, or a corporation, or nonprofit. While many people do this as a first step, it only causes confusion down the road. An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service.

Make it official—register a business with the industry leader in online business formation There are several items you’ll need to obtain an itin. The cost to apply for your itin number is free.

You don’t have to pay to apply for your itin number. You can apply for an itin tax id for you, your spouse, and your dependents when you prepare your tax return with us. File taxes and claim benefits.

Here’s what an itin can help you do. For check itin status you have to call: Start your itin application here how do you get an itin if, first of all, you have to qualify for one and second, you need to correctly fill out the paperwork.

The first thing you need to do to retrieve a copy of your itin number to call the irs’s number, 1. The irs issues itins to individuals who are required to have a u.s. Three steps to applying for an itin from canada step 1: